If you are an Avista employee and nearing retirement, you are eligible for the extremely valuable pension benefit and need to stop and consider your options.

Over the weekend, you likely received an email notifying you that your benefit is changing.

While this may, or may not, mean you need to take action with your pension itself, it certainly calls for your attention to ask yourself these 4 questions.

Here is that list:

What is the change that is happening?

As you well know, one of your premier benefits as a long-time Avista employee is your pension plan.

What you might not be aware of, is the impact that interest rates have on your plan benefits.

You see, these pension plan changes are not derived by Avista changing your benefit from an employer contribution perspective. Rather, the lump sum value of your pension benefit is changing based on the economic conditions or interest rates.

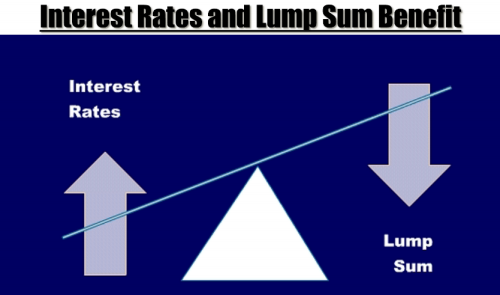

It is similar to the way your 401k plan value changes based on the value of the stock market and underlying investment options that you have selected. Your pension lump sum benefit changes based on interest rates.

As interest rates go up, the lump sum value of your pension goes down. In 2023, due to higher interest rates, Avista lump-sum values could be reduced by as much as 20%.

What is the Avista Pension Benefit Timeline?

Let’s pretend for a second that you are thinking of taking the lump-sum option. Really, you are trying to maximize the lump-sum option by either working longer or taking the option when interest rates are lower.

If you are looking to retire from Avista in the next couple of years, now is the time to review the lump sum option. As an example, working an additional two years but taking your lump sum during higher rates may actually reduce your lump sum benefit.

In short, your timeline for retirement is likely the biggest factor in making this decision.

Below is the timeline to retire in 2022 from Avista and take advantage of the higher lump sum:

| Deadline | Action |

| October 31, 2022 | Request Calculation for Lump Sum |

| November 14, 2022 | Submit Paperwork for Retirement |

| December 1, 2022 | Retirement from Avista |

How do I make a decision?

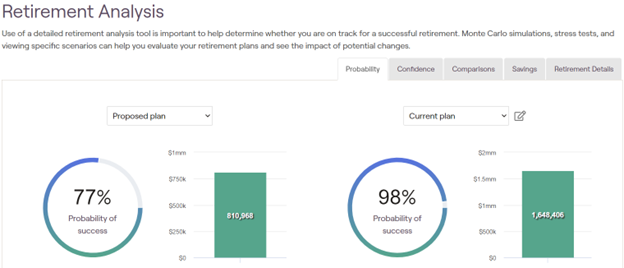

In order to understand how the new lump sum pension calculation impacts your retirement plan, you must first know where you stand today, to begin with!

Luckily, financial planning software is able to model your exact scenario, and how changes to different variables can impact your retirement plan.

Here’s a handful of input you need to know, to start addressing your retirement plan:

- Assets (401k, pension benefit, brokerage accounts, company stock, cash, etc.)

- Liabilities (mortgage or other debts)

- Cash Flow (current income and expenses)

- Goals (money is a tool, how do you want to leverage it in your life?)

What other financial impacts do I need to be considering?

Retirement has many irrevocable decisions and different levers that are used. When making a significant decision about retirement and pensions, we believe it is critical to use all variables and the proper tools. Each decision can have a lasting impact on the trajectory of your retirement.

Here are some of the common levers Avista employees have to pull as they near retirement:

- Health Care Expenses – Will you use the company plan? How long will your HRA cover these expenses?

- 401K – Do you rollover your 401K or keep its current plan administrator?

- Social Security – Does claiming early impact your lifetime benefit?

- Cash Flow – How will your income and expenses change in retirement?

- Taxes – What is your plan for taxes in retirement? Do Roth conversions make sense?

- Interest rates – Should you keep your mortgage?

There are a handful of times in your life when financial decisions must be made that will leave a lasting impact. This is one of them.

If you would like help in calculating if a higher lump-sum pension option makes sense for you, we have made it a priority to have a CFP® professional available for Avista clients this month.

To start the process, simply schedule a phone call with our team today.