If you haven’t seen it yet, I’m sure you will soon. The Instagram post asking you which is better, “this” or “that.” Forcing you to make a selection between two over-the-top amazing choices.

Would you rather:

This snow-covered ski cabin in the woods OR that beach house with white sand

This slice of mile-high chocolate cake OR that homemade apple pie

You get the picture.

But why do we have to pick sides? Is one phenomenal vacation location really better than the other? What if “both” is the best answer?

When it comes to building your net worth, the most heated debate we see is the real estate investing vs. stock market investing debate. It’s almost as polarizing as Biden vs. Trump.

But in this case, I will absolutely argue “both” is the best answer you can give.

The evidence:

For this article, we will reference a 22-year study completed by CEM Benchmarking that outlines the performance of the $3.6 trillion asset classes used by defined-benefit pension funds in the United States.

Admittedly, any individual investment will have its unique return characteristics. But the data surrounding various asset classes, including real estate investments, in the CEM study can give us a good feel for how these investing concepts can translate into your net worth.

This: Investing in Real Estate

Most would agree that it is possible to build wealth through investing in real estate. But where the debate can really start to take off is just how good of an investment real estate is.

Hence the “this or that” debate I see time and time again with individuals building their net worth.

So what does the data say?

The CEM Benchmarking study utilized 12 different asset classes. These asset classes included broader categories consisting of stocks, fixed income, real assets, and other investment alternatives.

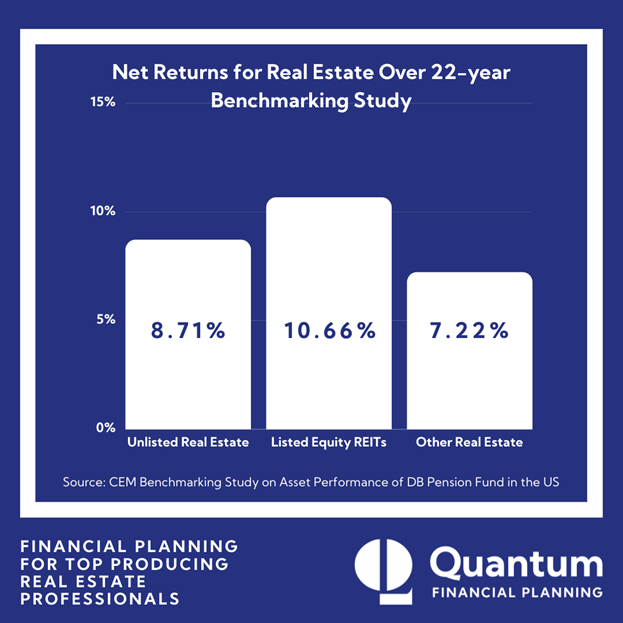

Within the real estate category, the study tracked three implementation styles of real estate investments: unlisted real estate, listed equity REITs, and “other.”

As you can see in the graphic below, each real estate type showed a strong performance over the 22-year period in the study.

In fact, listed equity REITs boasted the second-highest rate of return for the period for all asset classes!

The only asset class that could outperform listed equity REITs was private equity, coming in at an 11.87% net return per year. And keep in mind, this is an asset class that is typically unavailable to the average investor.

That: Investing in the Stock Market

And now we turn to the stock market crowd.

Were you invested for the tech bubble in ’01? Maybe the financial crisis of ’08? Or maybe you picked up some Tesla stock way back in 2013.

Depending on your answers to those questions and even your actions taken during those times, you may have very different feelings about the stock market.

But what does the data say?

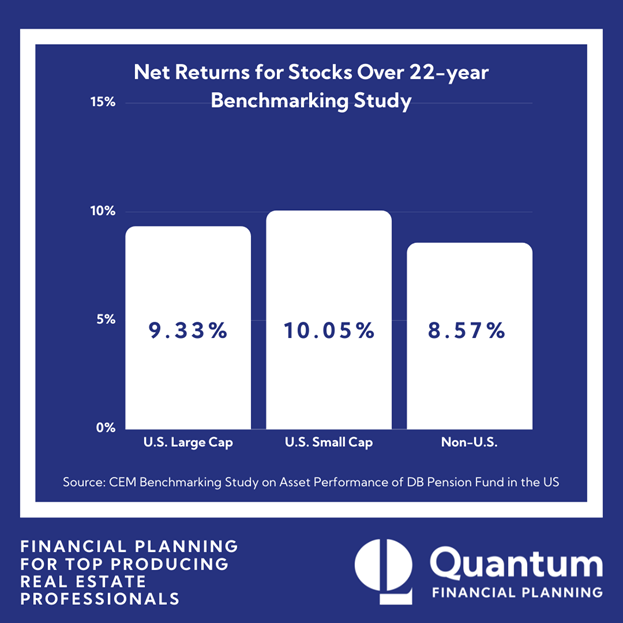

Again turning to the CEM Benchmarking study, it tracked three different types of stocks over 22 years. Below are the results:

Similarly, to the real estate asset classes, stocks performed well over the 22-year period in the study.

Invest in Real Estate or Invest in the Stock Market?

With the data in our hands, we can clearly see that listed equity REITs were the top performer of all the study’s real estate and stock asset classes.

They outpaced U.S. small cap stocks by an average of .61% per year!

Wait, so you’re telling me the monumental debate over which investment is better—real estate or the stock market—comes down to a mere .61% difference over a 22-year period?

There has to be more to the story here. And there is.

But to find this answer, you have to start asking a different question than “this or that.” You need to expand your thought process to include “both” as an acceptable answer.

Both: Math Says Diversification Can Produce the Best Result

Diversification isn’t a new concept to most, but understanding its benefits can sometimes be tricky.

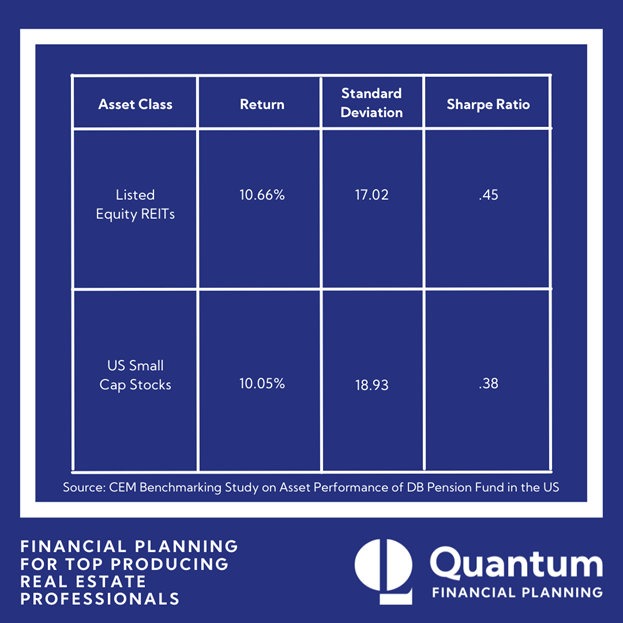

At its core, the greatest benefit of diversification is reducing the over volatility, or risk, for an investment portfolio. One way to measure this benefit is a metric called the Sharpe ratio.

Sharpe ratios can be read by simply knowing that the higher the resulting Sharpe ratio, the better the risk-adjusted result for an investment.

Below are the metrics for the top-performing asset class from each of the stock and real estate categories:

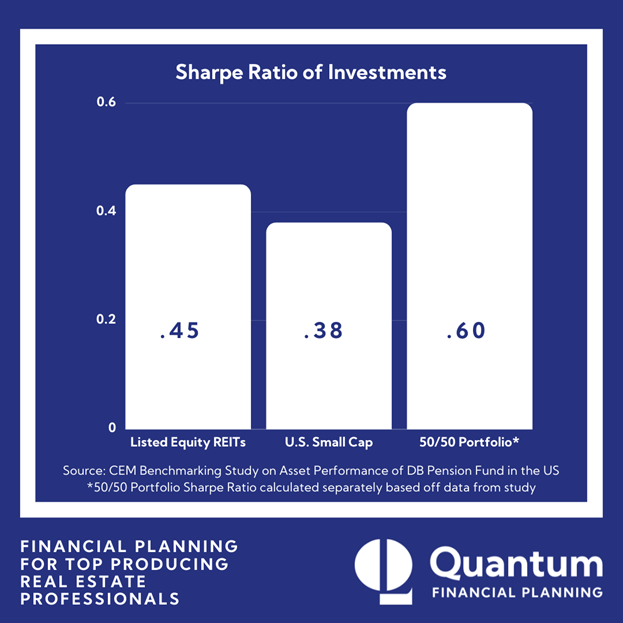

We have already established that both real estate and stocks can be good investments in the long run. But now let’s take a look at what happens when we do both.

Below are the metrics for a portfolio derived of 50% of the top-performing real estate asset class and 50% of the top-performing stock asset class in the study:

As you can see, the 50/50 portfolio that combines both U.S. small cap stocks and listed equity REITs generated a Sharpe ratio higher than each investment could generate on its own.

In fact, with the 50/50 portfolio, you would have generated 33% more return in exchange for the amount of risk that you took over the time period!

Applying the Data to Your Net Worth

The study we examined today certainly has its limitations, but here is the main concept I hope you can walk away with:

Don’t limit yourself to being only a real estate investor or only a stock investor.

The takeaway from the returns we observed in the CEM Benchmarking Study shows us that implementing a diversified portfolio of real estate and stock market investments could reduce the overall amount of risk you are taking with your net worth.

On top of the rates of return shown in the study, each asset class has its own set of additional tax benefits we didn’t even factor in.

Why would you limit yourself to building your net worth with only half of the tools you have available in your toolbox?

There is no wrong way to build wealth. In fact, I argue you should strive to build your wealth in more ways than just one.

Schedule a complimentary insight meeting to discuss your situation and how we may be able to help.