The Complete Guide to Realtor Retirement Plans – 2024 edition

As a real estate agent, your role as a small business owner comes with a plethora of tools and flexibility to help you get the most out of your hard-earned GCI. However, reaping these benefits requires proactive utilization of available resources.

When it comes to strategic tax planning, one significant tool available to real estate agents is the ability to contribute to a retirement account. Picking the right retirement account isn’t as simple as checking a box; it’s a crucial decision that can significantly impact your tax bill, potentially saving you tens of thousands of dollars.

There are several retirement plan options to navigate, each with its own advantages and disadvantages. In this guide, we’ll explore these options and help you determine the best fit for your real estate business, considering both tax implications and cash flow dynamics.

Stick around to the end, where we’ll review the connection between contributions to a retirement plan and the tax return of a real estate agent.

Here we go.

Realtor Retirement Plan #1: Traditional IRA

Traditional IRA’s are the best retirement account for agents early in their careers. Not only are they the easiest retirement account to implement, but they also have the lowest contribution limits.

If you are just getting your real estate business started and haven’t reached a point where you can make large contributions, simplicity is key.

When you’re just starting, there’s no point in setting up a more complex small business retirement plan (like we will review shortly). Your savings goals at this stage can be achieved by using a Traditional IRA.

Remember, the contribution limit referenced below is the maximum you can contribute to the account for any given tax year. However, if your cash flow isn’t quite there yet or you’re hesitant to dip too far into your emergency fund to make the max contribution, flexibility is built in. You can always make a smaller contribution that fits your current financial needs.

Tax Year 2023 Contribution Limit: $6,500

Age 50+ “Catch-Up” Contribution: $1,000

Contribution Deadline: April 15th of the following year

Contributions Required Every Year: No

Realtor Retirement Plan #2: SEP IRA

SEP IRA’s are the “go-to” retirement account for agents who have outgrown a Traditional IRA, and for good reason. Similar to Traditional IRAs, SEP IRAs are very easy to establish and fund. However, there’s a notable difference in contribution limits. Unlike the simplicity of Traditional IRAs, SEP IRAs moves away from being funded by you as a taxpayer and is instead funded by you as a small business owner.

As a result, the max amount that you can contribute is a calculation of your business income for the given year. This figure may not be known until your books are reconciled for the calendar year. The calculation for your SEP contribution varies depending on how your real estate sales business structured. See below:

Option #1: Sole Proprietor or LLC

Generally, take the net income listed at the bottom of your Schedule C on your income tax return and multiply this number by 20%.

Example #1: If your net business income is $100,000 for 2023, you have until you file your income tax return to make a SEP IRA contribution of $20,000.

Option #2: S Corp

This is where a SEP IRA can start to limit you. You see, when your business is structured as an S Corp, your SEP IRA contribution is limited to 25% of your W2 wages.

Example #2: The net income of your real estate sales business is $200,000, but you are structured as an S Corp and pay yourself a wage of $70,000. Generally, your SEP IRA contribution is limited to 25% of $70,000 or $17,500.

It’s crucial to note that while opting for an S Corp may reduce your SEP IRA contribution, it doesn’t necessarily make it a bad strategy for structuring your real estate business. What it emphasizes, is the importance of selecting the right retirement plan. SEP IRAs may not always be the optimal choice for an S Corp owner.

Tax Year 2023 Max Contribution Limit: $66,000

Age 50+ “Catch-Up” Contribution: Not offered as contribution is 100% funded by employer (I know, this is still you)

Contribution Deadline: Tax filing deadline including extensions to October 15th of the following year

Contributions Required Every Year: No

Realtor Retirement Plan #3: Solo 401k

For many agents structured as S Corporations, the perks often come with notable limitations on retirement contributions. If you find yourself running into these constraints, upgrading your retirement account to a Solo 401k might very well solve your problem.

Here’s why a Solo 401K might be a game-changer:

Solo 401k plans operate similarly to SEP IRAs for business owners, capping your contribution at 25% of the W2 wages that you earn as an employee of your business. However, what sets the Solo 401k apart is its additional benefit – the opportunity for you to contribute as an employee of your business.

After you contribute the 25% employer contribution based on W2 wages, you can defer up to $22,500 of your W2 wages as an employee of your business.

Let’s revisit the earlier scenario:

The net income of your real estate sales business is $200,000, but you are structured as an S Corp and pay yourself a wage of $70,000. Generally, your employer contribution to a Solo 401k is limited to 25% of $70,000 or $17,500. In addition to the employer contribution, you may defer an additional $22,500 of the $70,000 of wages you paid yourself. This brings your total contribution in this scenario to $40,000. A meaningfully higher deduction on your income tax return!

Before declaring the Solo 401k the best fit for every real estate agent, let’s talk about the added complexities that come with it. While not excessively more intricate, setting up a Solo 401k plan adds complexity with the need to defer contributions via payroll. This will likely require some coordination with your payroll company and CPA.

Solo 401k plans also have additional IRS requirements, such as filing Form 5500 once the plan assets breach $250,000. These actions, though manageable, should be considered. I’m a firm believer in only adding complexity when necessary. While the Solo 401k is a powerful retirement savings tool for real estate agents, it isn’t a one-size-fits-all solution.

Tax Year 2023 Max Contribution Limit: $66,000

Age 50+ “Catch-Up” Contribution: $7,500 (bringing the 2023 max contribution up to $73,500)

Contribution Deadline: Broken into two parts. Employee contribution: This must be deferred from your wages via payroll, meaning it will need to occur within the calendar year. Employer contribution: This portion likely will not be able to be calculated until your books are reconciled for the calendar year and then needs to be contributed to the account before filing for income tax return.

Contributions Required Every Year: No

Realtor Retirement Plan #4: Cash Balance Plan

For real estate agents who have achieved the pinnacle of success in the industry, there lies a lessor-used retirement plan option that offers significant tax savings beyond even a Solo 401k plan – the Cash Balance Plan.

Cash balance plans are an entirely different category of retirement plan known as defined benefit plan, operating under an entirely different set of rules. Contribution amounts to these plans must be calculated by an actuary, factoring in income levels, time in the plan, and plan assumptions.

Additionally, having a Cash Balance Plan doesn’t disallow you from having a Solo 401k plan. This means you can leverage both plans simultaneously for your business, maximizing your retirement savings potential.

*Example: You are a real estate agent earning $330,000 at the age of 52. Your business could contribute $239,500 to your Cash Balance Plan plus an additional $49,800 to your Solo 401k plan bringing your total deductible contributions to $289,300.

*Note: Calculations require an actuary and this example was provided by: https://www.dedicated-db.com/compare-defined-benefit-vs-defined-contribution-plans/

While Cash Balance Plans allow for significantly larger contributions and greater tax benefits, it’s essential to be aware of certain considerations. Unlike all the other plans reviewed earlier, once you start contributing to a Cash Balance Plan, the IRS typically expects continued contributions for an extended period, limiting the flexibility to skip contributions for a year.

Customization is key with Cash Balance Plans, requiring additional professionals to build tailoredplan documents at an associated cost. However, the potential tax benefits of a Cash Balance Plan are likely to far exceed any costs associated with the plan. If you’re contemplating a Cash Balance Plan, careful consideration and professional guidance are crucial for optimizing the tax advantages it can offer.

Tax Year 2023 Max Contribution Limit: $265,000

Age 50+ “Catch-Up” Contribution: N/A

Contribution Deadline: Up to tax filing deadline including extension, typically September 15th

Contributions Required Every Year: Yes

Tax Impact of Retirement Plans

You might be pondering, “I know I need to be saving for my future, but what immediate tax benefit do I gain from these retirement plans today?”

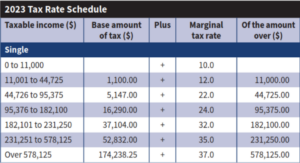

In the United States, our tax system operates on what is called Marginal Income Tax Brackets.

Here is what they are for 2023 for a single tax filer:

In light of this, the contributions you make to a retirement account reduce your taxable income. This means you can determine the tax benefit by multiplying the dollar amount you contributed to your retirement plan by the marginal rate of the bracket that those dollars fall into.

Example: You are a single filing real estate agent with a taxable income for 2023 of $230,000. You do not have an S Corp and make the maximum SEP IRA contribution of $46,000 for your income level. Since the entirety of this $46,000 falls into the 32% marginal income tax bracket, your tax savings is estimated at $14,720. Please note, this example excludes the rest of your tax situation, like the standard deduction, for simplicity.

As you can see, the impact of making these retirement contributions is one of the most influential levers you have to pull as a small business owner looking to reduce your tax liability.

Still have questions about which retirement plan is right for you?

You can schedule a call with a CFP® who specializes in working with successful real estate agents, just like you.