This article highlights three areas that should be driving your decision-making when it comes to taking advantage of today's low interest rate environment.

EXECUTIVE SUMMARY

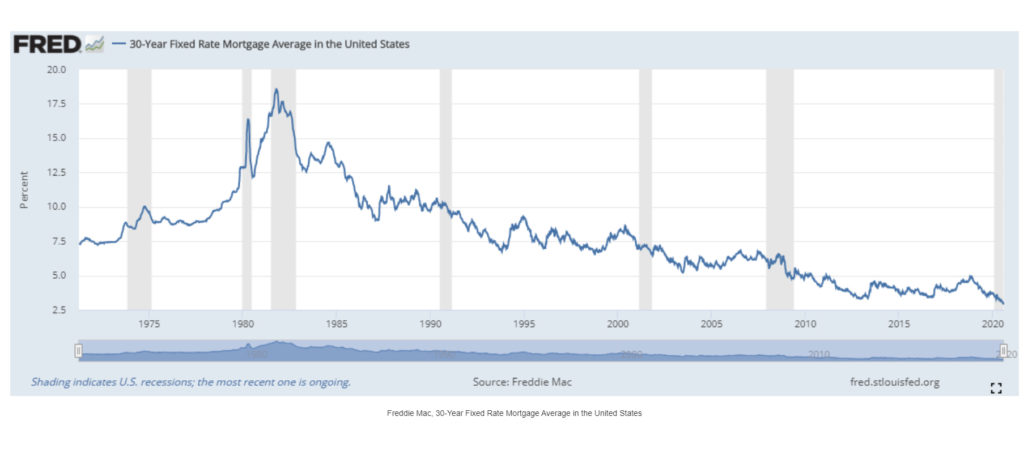

Historically low interest rates have become a byproduct of the Federal Reserve’s attempt to combat the economic crisis caused by COVID-19. While we were already experiencing near record lows coming into the year 2020, we have now officially moved into record territory. This spurs the question: What actionable financial planning opportunities are available in this record setting environment? According to the most recent study by the US Census Bureau, Home Equity accounts for 34.5% of the average American’s net worth, the largest percentage of any category. Today we take a look at three areas that should be driving your decision-making when it comes to taking advantage of today’s low interest rate environment.

- What is my propensity to risk?

- How does this affect my overall planning goals?

- Does the math work?

Source: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, August 11, 2020.

What is my risk propensity?

Monthly Payments

At the root of a mortgage agreement on your home is an exchange of value today for you, the borrower, and the promise of future payments, plus interest, to the lender. This relationship means that the more money we borrow, the more we are required to submit as payments in the future. There are some basic rules of thumb when looking at how high of a monthly mortgage payment you should take on, such as the Rule of 28. By this guide, the highest your mortgage payment should be is 28% of your gross (before taxes) monthly income. For example, an individual earning $150,000 per year should not take on a mortgage higher than $3,500 per month. The higher the monthly payment you commit yourself to, the more potential risk you are taking with your financial plan.

Time horizon into retirement

The importance of the mortgage affordability is compounded when the time horizon of retirement is taken into account. When looking to refinance your home, it is critical to remember you will be selecting a new term for the loan to be paid back. Meaning, if you are 50 years old and plan to retire at age 65, for a 30-year mortgage you now need to be planning on covering that mortgage for 15 years of retirement. Depending on your situation, this could very well still make good sense with the previously mentioned historically low interest rates we are currently experiencing, but it is vital that this extended expense is accounted for in your retirement plan.

Leverage

The concept of leverage is essential to the thought process of taking on or refinancing a mortgage. By borrowing from the bank instead of paying with cash, you are now able to utilize those resources for other things. When looking to refinance, it is important to understand if you are adding, reducing, or maintaining the same amount of risk to your financial plan. If you are extending the term or amount of the loan in the process, you are increasing your leverage and taking on the risk that comes with it. Conversely, if your refinance package matches or reduces the loan amount, or the length of the term, you are decreasing your leverage over the time of the loan and reducing your risk. When looking at a refinancing your property, one should evaluate the opportunity cost of taking on the loan. If you are adding leverage, what will you do with lump sum or increased cash flow on a monthly basis, and are you comfortable with the risk that comes with it to your financial plan?

How does this affect my overall planning goals?

When making decisions around one of the largest assets in your net worth, we recommend circling back around to your overall planning goal. Refinancing your home can have numerous large implications on the other financial goals that you may have in place for yourself.

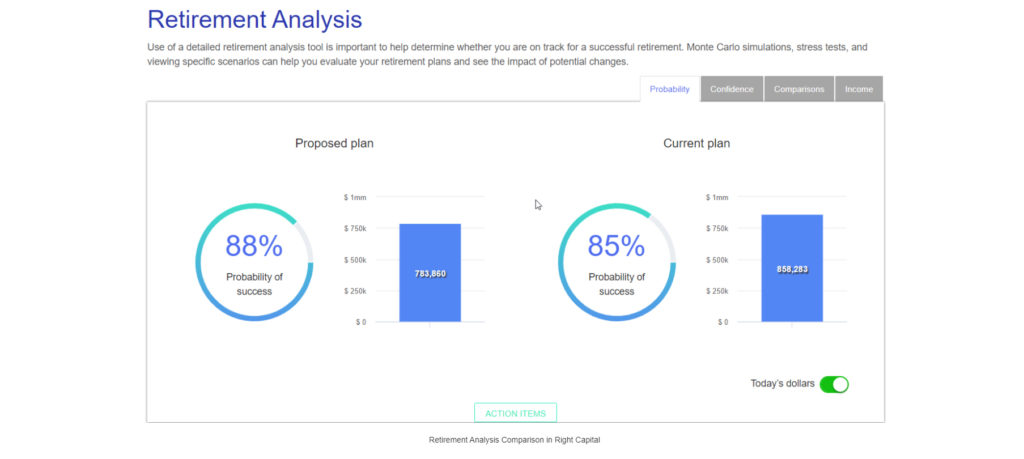

Making sure that your financial plan has you on track for your desired retirement timeline and lifestyle is typically high up on the list of goals to keep in mind. That said, these scenarios can look very different dependent upon the path chosen regarding financing your home. Let’s take a look at a few examples below:

Retirement Goal #1 – Highest net worth possible

This theoretical scenario would include maximizing the leverage on your home in order to put assets to work in other areas that would experience a higher long term expected return than the amount of interest you are paying on your home. With this higher return, comes the risk of the assets for which you are investing in. Depending on your circumstances, you may need to adjust your lifestyle at times to counterbalance the volatility of your investments. Although this scenario may have a higher ending net worth, it also comes with a lower probability of success due to the increased risk of leverage.

Retirement Goal #2 – Most stability possible

This theoretical scenario would include minimizing all debt and the leverage that comes with it. Due to the reduced amount of expenses required to achieve your retirement timeline and lifestyle, this financial plan is much more predictable. That said, you also have less assets invested and growing in other areas of your net worth. The likely outcome would be a lower ending net worth, but the trade-off is a higher probability of success for achieving your retirement lifestyle and timeline.

Retirement Goal #3 – Somewhere in-between

Although modeling in absolutes works well for creating a point, I do believe it is prudent to mention a third and possibly more likely option of “somewhere in-between.” Some of us may be convicted to pursue either of the two retirement goals mentioned above, but I believe a likely outcome for most would be in this category. This biggest component to landing in the “somewhere in-between” category is understanding the full implications of the decision and getting your financial plan risk to a level that you personally feel most comfortable with.

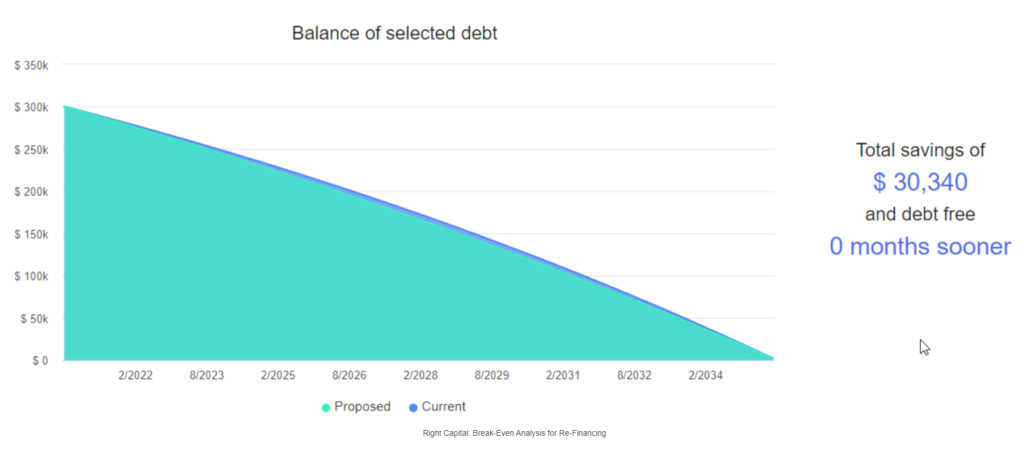

Example Comparison: “Proposed plan” models a potential “Most stability possible” goal while the “Current plan” adds leverage to the mock scenario and models a potential “Highest net worth possible” goal. Source: RightCapital financial planning software.

Does the math work?

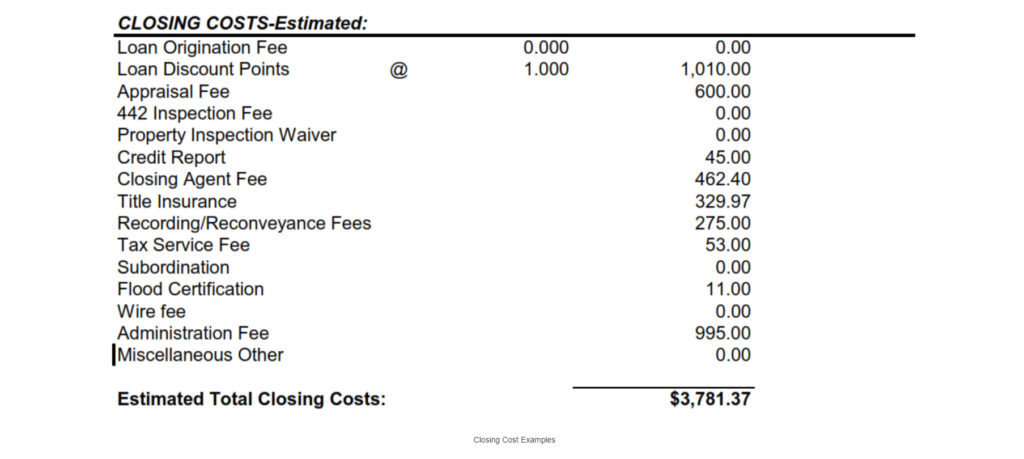

In some instances, when a refinance is available that holds all other factors constant (loan amount, term of loan, etc.) and the only factor changed is a reduced interest rate the decision can be boiled down to a simple break-even analysis of the cost to refinance. To calculate the break-even, you will need two things: An estimated closing costs explanation document and a current mortgage statement.

Cost to refinance

The first component we will look at is the cost to refinance. This is the amount that the bank charges when the create your new loan. Some common items to include: Origination charges, discount points, appraisal fees, administration fees, etc. This should be provided by the loan officer you are working with and you can see an example below:

One of the key decisions to make when analyzing the cost of the refinance is the choice to purchase discount points. This is an option that allows you to pay an upfront cost at closing in exchange for a lower interest rate on your loan. Depending on your circumstances, this could be a good or bad deal for you so be sure to take this into consideration when closing on the loan. The best way to evaluate this is to run a break-even analysis for both buying points and accepting the standard rate. The longer it takes to get your money back on buying the interest rate down, the less inclined you would be to purchase points.

Interest rate arbitrage & break-even analysis

Next, we examine the differences in your current payment versus the proposed new mortgage amount. Holding the other major factors here constant (loan amount and term) the primary driver will be the difference in interest rates. After we have identified the difference in monthly payments for the two options, it is simple math to divide the cost that the bank is charging to refinance by the monthly savings that will be achieved by obtaining the lower interest rate. Once the mortgage has been held for at least this amount of time, all remaining payments will contribute to further savings by the homeowner.

Source: RightCapital financial planning software, example illustrates a Current Mortgage with 15 years remaining at 4% interest being replaced by a Proposed Mortgage with a 15-year term and 2.85% interest.

Time horizon in the home

One final item to think about when considering the math behind refinancing your home is your time horizon in the dwelling. When refinancing in a vacuum, we are trading upfront costs today in exchange for lower payments in the future. The key here is that we actually are in the home long enough to experience enough reduced payments to make the math work. While we all know life happens and plans can change, keep in mind what your timeline in the home looks like when making this decision. In general, the longer you see yourself in the home, the more sense it makes to refinance to a lower interest rate.

Conclusion

In summary, the presence of historically low interest rates creates a very real opportunity for individuals to assess their current mortgage situation. Depending on the implementation of a potential refinanced home, individuals may be able to enhance their retirement plan by reducing debt service expenses. That said, when making the decision individuals need to be aware of how various refinancing options will impact their overall financial plan and ability to achieve their long-term goals.

This comes down to asking yourself three questions:

- What is my propensity to risk?

- How does this affect my overall planning goals?

- Does the math work?