When it comes time to retire, many people are faced with deciding whether to take their pension in a lump sum or as monthly payments. There are pros and cons to both options, and the best choice for you will depend on your circumstances. Unfortunately, it isn’t a one size fits all, so the right decision for you may be different from your co-worker or Aunt Sally.

7 Pension Questions to Decide on Lump Sum or Monthly Payments

1. How financially stable am I?

Financial stability is your ability to cover their expenses. Financial stability depends on different income streams, retirement benefits, and lifestyle. In general, the more financially stable you are, the better a lump sum will give you options in retirement as you will be able to spend or invest the money as you see fit.

If you are financially stable, you may be able to afford to take a lump sum and still cover your living expenses. This will give you the flexibility to do things like pay off debt, take bigger vacations, or remodel your home.

If you are less financially stable, you may be more inclined to take the pension. This is because the pension will provide you with a guaranteed income for the rest of your life. This can help you reduce the risk of outliving your retirement savings.

2. Does my pension have an inflation rider?

An inflation rider or cost-of-living adjustment (COLA) will increase your pension payments each year to keep up with inflation. If your pension does not have an inflation rider, the value of your payments will erode over time. This can make it difficult to maintain your standard of living in retirement. You can learn about other ways to prepare your assets from inflation from an article I wrote, Inflation: What is it, how does it affect me, and how do I beat it?

Note: Social Security has an inflation rider that increases each year based on Consumer Price Index (CPI). However, many private pensions do not have an inflation rider and this can have a large impact on the decision.

Purchasing power after inflation without an inflation rider

|

Age |

2% Inflation |

3% Inflation |

4% Inflation |

|

62 |

$ 3,000 |

$ 3,000 |

$ 3,000 |

|

72 |

$ 2,451 |

$ 2,212 |

$ 1,994 |

|

82 |

$ 2,002 |

$ 1,631 |

$ 1,326 |

|

92 |

$ 1,636 |

$ 1,203 |

$ 881 |

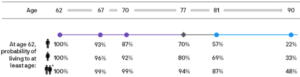

3. How long do I expect to live?

If you have a long time horizon, you may be more inclined to take the pension. This is because the pension will provide you with a guaranteed income for the rest of your life. On the other hand, a lump sum gives you flexibility in later years when healthcare costs may be higher.

The below table shows the probabilities of 62-year-olds and their life expectancy. Note that there is a 48% chance that at least one person in a married couple will live to be 90.

*Source: JP Moran Guide to Retirement

4. Am I comfortable with owning investments?

When taking the pension option, you immediately annuitize the benefit and no investment management is needed. This is best for people that are not comfortable with investing and are not working with a financial planner. If you are more risk-averse, the pension option may be right for you.

If you take the pension lump sum option, you will receive the total sum and roll it into a retirement account (most tax efficient). Once you receive the lump sum, investment management is up to you and your financial planner. Using a financial planner helps guide you through life changes and will review, manage, and optimize your asset allocation.

5. Do I want to pass money to my heirs?

A lump sum payout not only gives you flexibility in your retirement, but also allows you to distribute the money to your heirs as you see fit. Furthermore, the money that is not spent throughout your life will be passed based on your intentions to family, charities, or others of your choosing.

With a pension, once you or your spouse pass away the income and benefits end. If your main concern is having a stable income and the loss of unused benefits isn’t a high concern, then the pension could be the better option.

6. Is someone else dependent on this benefit?

When considering a pension, it is important to consider your survivorship needs. If you have a spouse or other dependents, you may want to consider taking a pension with a survivorship benefit. This will ensure that your loved ones will receive an income after you die.

Survivorship benefits come in a variety of forms. Some plans offer a full survivor benefit, which means that your spouse will receive the same amount of money after you die as you did while you were alive, but this comes with a reduced benefit. Plans usually provide multiple options and you will need to weigh the option of reduced benefits to guarantee income for your spouse.

Here’s an example of the reduced benefit of taking the Survivorship Option:

|

Monthly Pension |

Survivorship Option |

|

$ 3,000 |

No Survivorship Option |

|

$ 2,712 |

50% Survivorship Option |

|

$ 2,628 |

66.67% Survivorship Option |

|

$ 2,475 |

100% Survivorship Option |

7. What are the tax implications?

Pension income will be included in your taxes as ordinary income in the year you receive it. Therefore, you will pay taxes on the full amount of the pension, regardless of how you use it.

If you take a lump sum, you will have more flexibility in how you pay taxes on the money. You can choose to increase or decrease the amount that you take each year to minimize your tax liability. In addition, you have options to convert the benefit to a Roth account or make qualified charitable distributions to reduce your taxes as well.

Putting it all together

The decision to take your pension vs. a lump sum is a complex one, and the best option for you will depend on your circumstances. Each factor we have outlined is weighted differently depending on your family and needs; reviewing them will help make the right decision.

Quantum Financial Planning specializes in working with families to create financial plans and helping them make the right decision. If you are interested in learning more, please contact us today.