Did you have an all-time-high GCI this year?

If so, congrats! Your hard work and expertise paid off, and you were able to help a record number of people this year.

But let me encourage you not to stop there with your financial success.

Just earning a high gross commission income (GCI) isn’t enough to build wealth.

In fact, earning a high GCI without taking action in your finances leaves you ending the year in the same position you started.

As we kick off 2022, coming off of a year where you crushed it in your real estate business, be sure to take action with your hard-earned GCI and crush it in your personal wealth too. It’s how you deploy your high GCI that determines your wealth.

How to Build Wealth

Here are three steps you can take to help build your wealth.

Fully fund your emergency fund

While the “rule of thumb” for the average person’s emergency fund is three to six months of living expenses, top-producing real estate professionals typically require being on the higher end of this spectrum. We recommend proactively building out your personal cash management plan for your unique lifestyle.

As a small business owner, you have variable income that adds a layer of uncertainly the average person doesn’t have to deal with, and typically calls for a higher-than-average emergency fund as a result.

Remember, by definition, emergency funds consist of only cash assets that assume no risk.

Due to this limitation, you will want to feel out the right mix of checking account and high-yield savings account (HYSA) usage to optimize your situation to your needs.

Open a brokerage account

The biggest risk to your emergency fund is inflation, and the best way to guard against inflation is to own appreciating assets.

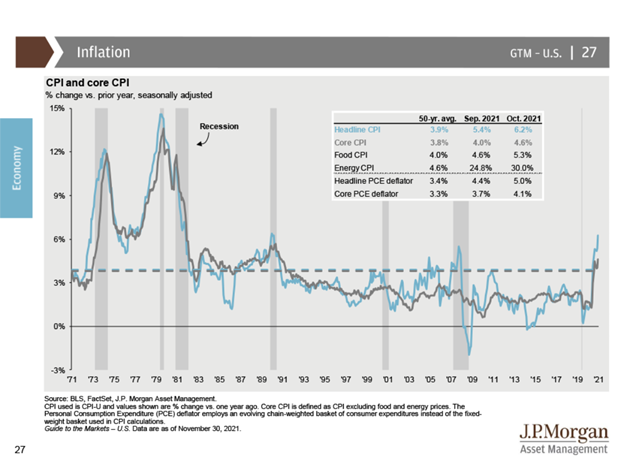

Coming off a year where inflation spiked to the highest levels we have seen since 1990, it is certainly a risk to consider.

Brokerage accounts can be a great tool to fight against inflation in your net worth.

They allow you to invest in assets that have the potential to appreciate at a rate exceeding inflation, unlike cash. But they also provide the flexibility to access the funds without early withdrawal penalties, unlike a retirement account.

That said, brokerage accounts have their own set of market risks depending on the underlying asset you invest in.

The bottom line is this: Don’t abandon your emergency fund because you fear inflation, but also be deliberate about building a net worth that will hold up over time against the drag in value inflation creates.

Diversification is key.

Max out your retirement plans

A variety of factors will dictate the optimal retirement plan for you, such as your income level, your business structure, or if your brokerage offers you a retirement plan option.

Whatever route your select, be sure to take full advantage of the tax benefits that come with it.

Below are the 2022 contribution limits for plans utilized by Top Producers:

- Solo 401(k): $61,000

- SEP IRA: $61,000

- Roth IRA: $6,000

- Health savings account (HSA): $3,650

Not sure which plan makes the most sense for you?

Check in with your financial planner to talk through your situation and implement the plan that best serves your needs.

Schedule a complimentary insight meeting to discuss your situation and how we may be able to help.