Inflation and Retirement: 3 Strategies to Protect Your Money

Inflation is a still hot topic these days for good reason. The rate of inflation has come down from the highs of 2022, but is still putting a strain on many people’s budgets. If you’re approaching retirement, inflation can be even more of a challenge, as your retirement savings may not be keeping up with the rising cost of living.

In this blog post, we’ll discuss five strategies that can help you beat inflation in retirement. We’ll cover everything from investing in appreciating assets to making smart spending decisions. So whether you’re just starting to plan for retirement or you’re already retired, read on for some helpful tips.

First, let’s define inflation so we have a baseline.

What Is Inflation?

Inflation is an increase in the prices of goods and services. As prices rise, your purchasing power decreases, meaning you can buy fewer goods and services with the same amount of money. The higher the inflation rate, the more your money loses value.

Inflation isn’t always a bad thing. It can be a sign of a healthy economy, as it can lead to higher wages and increased asset values. However, too much inflation can be harmful, as it can erode people’s savings and make it difficult for businesses to plan for the future.

How is Inflation Measured?

Economists measure inflation in many ways, but the most common measure is the Consumer Price Index (CPI). The CPI measures the average change in prices for a basket of goods and services that are commonly purchased by consumers. The CPI is broken down into several categories, such as food, energy, shelter, and transportation.

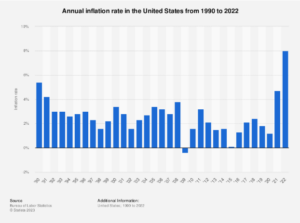

The April 2023 CPI Report index by the U.S. Bureau of Labor Statistics shows an increase of 4.9% over the previous 12 months. Which is well above the 20-year average of 2.5%.

Source: Bureau of Labor Statistics

The Federal Reserve—“The Fed”—is the organization tasked with keeping inflation in line. The Fed’s goal for long-term inflation is 2%; however, we’re well above that mark.

The Fed has a dual mandate: (1) price stability and (2) maximizing employment. The Fed has three tools to manage its mandate, but the most effective and widely used tool is the federal funds rate. This is the interest rate that banks lend money to each other overnight. When the Fed increases rates, borrowing money becomes more expensive, which slows lending and, in turn, the growth of the economy.

If you increase the federal funds rate too quickly, you can shock the economy into recession. The Fed is currently trying to tight-rope the balance of slowing down inflation while not killing the expanding business cycle.

How Does Inflation Affect Me?

Inflation affects everyone differently depending on their age, the assets they own, and where their income comes from.

For example, inflation has a large effect on someone in their 20s who is renting and may experience a rental increase, versus someone in their 60s who owns a house and observes an increase in their asset’s value.

On the other hand, a person in their 20s may receive a salary increase with inflation, while someone in their 60s remains on a fixed pension and loses purchasing power in lockstep with inflation.

It’s important to look at each of your income and expense streams and evaluate how inflation may affect them. For example, do your income streams have a cost-of-living adjustment (COLA)? Thankfully, Social Security is adjusted annually to keep pace with inflation. However, pensions and annuities don’t have COLA or may be capped at a rate lower than inflation.

On the expense side, healthcare costs have been much higher than inflation for decades, and experts predict this to continue.

If you are a borrower, inflation is a good thing: Assets tend to appreciate faster in inflationary times, and the cost of debt is reduced, making it cheaper to repay.

3 Ways to Beat Inflation

Below, we’ll talk about three of the best ways to beat inflation, or at least, not lose.

1. Own Appreciating Assets

The best thing you can do to keep up with inflation is own appreciating assets. From history, we know stocks, bonds, and housing all increase faster in times of inflation. The assets inflation hurts the most include cash, low-interest savings accounts, and long-term fixed-rate bonds. When inflation increases, as we have experienced over the past six months, cash and savings accounts lose significant purchasing power.

2. Make Minimum Debt Payments

Most individuals try to reduce debt or stay debt-free, but having debt can actually be beneficial. When inflation rises, it makes your existing loans or debt less expensive. For example, if your mortgage rate is 3.5% and inflation is 4.9%, your nominal rate is -1.9%. Which begs the question: Should you pay down your debt or investment for the future? This is based on your risk level, but if you are trying to maximize your financial plan and total wealth, you should make minimum debt payments and invest the rest.

3. Invest Additional Money

The best place to start is to have a cash management strategy or an emergency fund. This amount should be in cash and savings accounts, but having more than you need reduces your future purchasing power. Depending on the amount of risk you want to take, here are four options to invest your additional money:

- High-yield savings accounts. HYSAs are currently yielding 4.0% and are backed by the Federal Deposit Insurance Corporation for up to $250,000. This yield will increase when the Fed raises rates. We like the below banks:

- Series I Savings Bonds. These bonds are issued by the federal government and have a variable yield calculated based on CPI and adjusted twice per year. Currently yielding 4.3%, they have a maximum investment of $10,000 per person per year. If you sell within the first five years, you lose three months of interest, so we recommend this security if you have over a one-year investment horizon. This product can only be purchased through the government, and the best place to buy is Treasury Direct.

- Treasury inflation-protected securities. The U.S. government issues TIPS, and the principal is indexed to inflation so purchase power doesn’t decline. There are no limits to the amount you can invest in TIPS, and they can be bought through mutual funds and exchange-traded funds (ETFs).

- Stocks and bonds. After reviewing your financial situation and making sure your short-term needs are covered, it might be the right time to increase your allocation to stocks and bonds to help reach your long-term goals.

Inflation Is Here

Although inflation has come roaring back unexpectedly, it is not the worst thing. It can be good for the economy as it shows it is healthy and growing, leads to higher wages, and increases asset values. This is the time to look at your financial plan and cash management strategy to see how prepared you are for different inflation scenarios and make sure your money is working for you, and you’re capitalizing on ways to beat inflation.

Consider working with a financial advisor who can help you determine the optimal tools and strategies based on your situation. Our Spokane financial planning firm offers a complimentary insight meeting and we’d love to talk to you about inflation and retirement. We invite you to schedule a meeting today.