How Much Does a Financial Advisor Cost?vUnderstanding Fees and Value

When it comes to hiring a financial advisor, one of the crucial factors to consider is how they get paid. Financial advisor compensation can vary based on the services they offer and the payment models they follow. What an advisor charges and the value they provide will be the top factors in who you choose to partner with.

In this article, we will delve into the three main ways financial advisors typically charge: Flat Fee, Assets Under Management (AUM), and Commissions. We will also discuss the value a financial advisor can provide and how to find the right-fit advisor for your unique financial needs.

In this article, we reference the 2022 Kitces Research Study, which addresses advisor pricing and was authored by Dr. Derek Tharp, Ph.D., CFP®, CLU®.

3 Ways Financial Advisors Charge

1: Flat Fee Financial Advisors

Flat Fee financial advisors charge a fixed rate either annually or hourly for their services, similar to other professional services like CPA or attorney fees. Some may also manage your assets, while others focus solely on providing financial advice. This model is suitable for those who want advice while retaining control over their portfolios, have smaller portfolios, or prefer paying directly for services.

Flat Fee Financial Advisors could be a good fit if you:

- Desire financial advice but want to continue to manage your portfolio yourself;

- Don’t have a portfolio built up quite yet; or,

- Prefer to pay your financial planner out of pocket instead of having the portfolio cover their fees.

According to the 2022 Kitces Research Study on Advisor Pricing, the average flat fee for financial advisor was $250/hr.

2: Assets Under Management (AUM) Financial Advisors

AUM financial advisors base their fees on the size of the portfolio they manage on your behalf. The higher your portfolio value, the higher the fee. Beyond investment management, AUM advisors may offer a broader range of financial planning services, such as tax planning, estate planning, and retirement planning.

What is the Average Financial Advisor Fee?

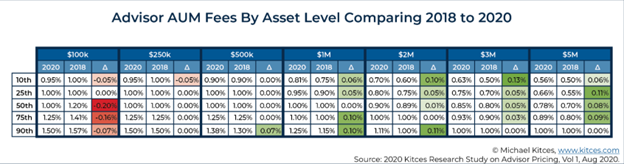

What is the average percentage a financial advisor charges? According to the 2020 Kitces Research Study on Advisor Pricing, a $1 million portfolio has an average financial advisor fee of 1% of the portfolio value.

As you can see in the graphic below, as portfolio size increases beyond $1 million, the average AUM percentage charged decreases.

Source: 2020 Kitces Research Study on Advisor Pricing.

Financial planners structured in this manner may still offer a wide variety of services for the fee that they charge.

For example, many financial planners operating under an AUM model include other areas of financial planning beyond investment management. These types of services could consist of tax planning, estate planning, and retirement planning, to name a few.

On the other hand, some financial planners limit the scope of their services to purely managing the portfolio in exchange for their AUM fee.

3: Commissions

Some financial advisors operate on a commission-based model, primarily selling financial products like insurance, annuities, mutual funds, and non-traded REITs. While this model exists, it’s important to note that commission-based advisors may prioritize product sales over providing comprehensive financial advice.

The cost of this compensation style can vary significantly based on the financial product being sold, so it’s essential to ask the advisor for the total cost of the investment.

The true cost of this advisor compensation style can vary dramatically depending on the financial product being sold. As a result, the best advice I can give is to ask the advisor for the total cost of the investment.

Below are some keywords that can help obtain that information:

- Front-end load

- Expense ratio

- CDSC (contingent deferred sales charge)

- Surrender period

- M&A expenses

- Annual account fees

Again, while none of the above-listed compensation methods is wrong, it is massively important that you understand how your financial advisor is getting paid and exactly what services are included with that fee.

Understanding the Value of a Financial Advisor

Finding the right financial advisor involves considering the value they bring to your financial life. Different individuals may seek different types of advisors based on their unique needs and goals.

For example, a real estate agent might require advanced financial planning for tax implications related to their business. In contrast, someone seeking to delegate investment management may opt for a lower-cost, investment-only financial advisor.

To assess the value a financial advisor can provide, consider factors like suitable asset allocation, cost-effective implementation, rebalancing, behavioral coaching, asset location, and spending strategy. Additionally, tax planning plays a significant role in optimizing an individual’s financial plan.

The best-case scenario for you as the client is to find a financial planner whose value outweighs the cost of hiring the professional.

While it can be difficult to put a hard number on the value of a financial planner, Vanguard makes a good attempt in compiling their Vanguard Advisor’s Alpha® report.

In this study, they attempt to assign value to each of the following areas:

- Suitable asset allocation

- Cost-effective implementation (expense ratios)

- Rebalancing

- Behavioral coaching

- Asset location

- Spending strategy (withdrawal order)

- Total-return vs. income investing

Additionally, we would argue that tax planning (which includes how you order your withdrawals) can deliver quantifiable value to the trajectory of an individual’s financial plan.

Conclusion

If you find yourself asking, how much does a financial advisor cost, we hope we’ve covered the variety of pricing methods on this page. Partnering with a financial advisor is a significant decision, both financially and strategically. Understanding how financial advisors are compensated and evaluating the value they can bring to your financial life are essential steps in making the right choice.

As a certified fee-only financial advisor in Spokane, WA, we offer strategic, all-encompassing, and ongoing financial planning services. We invite you to schedule a no-obligation complimentary insight meeting to explore how we can assist you in achieving your financial goals.