In this article, we’ll illustrate how the Roth IRA—an excellent investment vehicle in its own right—has an unlikely competitor in the retirement saving strategy category: the health savings account (HSA). Although designed as a tool to help cover medical expenses, HSAs have key benefits over the Roth IRA as long as you don’t mind a little record keeping!

First, let’s take a look at how the Roth IRA can play a part in retirement planning. You can fund a Roth IRA by investing income you have earned and, therefore, have already paid taxes on. Once invested, though, the money in the Roth IRA can grow tax-free.

Furthermore, you can take money out completely tax-free after turning 59 ½ so long as the account has been opened for more than five years. This is a great fit for individuals in lower tax brackets whose earned income is taxed at a lower rate, or for those who believe their taxes will be higher in the future.

Enter the unlikely, but worthy competitor, the HSA. For any contribution you make into your HSA, you can deduct that amount from your taxes. This is what sets the HSA apart from the Roth. Otherwise, though, the two are similar; the HSA will also grow tax-free and can get pulled out completely tax-free.

An HSA has one more major benefit, though: You won’t have to wait until 59 ½ to access the funds. For those looking to retire early, an HSA can provide more planning flexibility and make a big financial impact!

Let’s first examine some caveats regarding exactly who is qualified to open an HSA, and rules around using them. We’ll then dig a little deeper into the mechanics of using an HSA as a source for retirement income.

The Rules for Using an HSA

- You are allowed to fund an HSA only if a qualifying high-deductible insurance plan covers you.

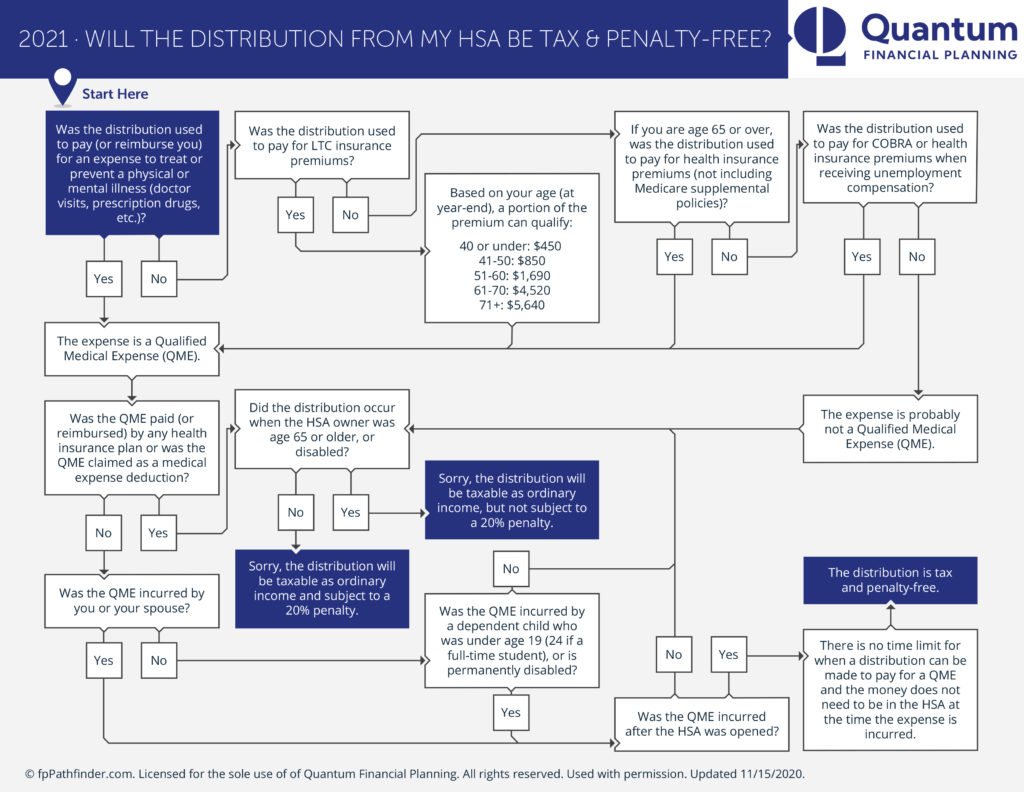

- You can only withdraw funds to pay for, or reimburse yourself for, qualified medical expenses.

- There are annual contribution limits associated with HSAs based on whether your insurance coverage is self-only or includes family members.

- You can invest HSA funds into stocks and mutual funds.

- HSA contributions and growth can stay in the account and do not have to be taken out each year.

- As mentioned, HSA contributions (a) can be used as a tax deduction from your annual income, (b) will grow tax-free, and then (c) come out tax-free if used for qualifying medical expenses.

- HSA accounts are not subject to required minimum distributions, like most retirement accounts.

How an HSA Can Boost Retirement Savings

Now let’s look at the typical way most people use HSAs and, truly, how they were designed to be used. An individual will fund an HSA, and then as medical expenses accrue, the individual will either use an HSA debit card to pay for medical services or pay out of pocket and get reimbursed from the HSA account.

Most HSA values do not grow very high, nor are the accounts maxed out often.

In contrast, here is the new way people are using HSAs to boost their retirement saving efforts. They are careful to max out their HSA every year but then pay for medical expenses out of their personal checking accounts. HSAs can be invested in the stock market, allowing the funds to grow with interest.

The key step to this system, then, is to keep track of all medical expenses over the years, along with records. The beauty of the HSA, you see, is that you can get reimbursed at any time, tax-free, from the account—even long after the date of service!

Let’s look at an example: A family puts $5,000 per year into an HSA for 10 years and lets the assets grow without tapping them for medical expenses. Over time, and with investment growth, the account sum after 10 years is $75,000. If they have had medical expenses of $4,000 per year for 10 years, and they kept good records of their medical expenses, they could pull out a $40,000 tax-free reimbursement from the HSA plan at any time!

Although this strategy requires a certain amount of forethought, record keeping, and patience, it gives the HSA plan member a great deal more flexibility when it comes to retirement planning. And it’s one strategy that our Spokane, WA independent financial planning firm often recommends to clients as part of their overall retirement plan.

A health savings account might be an excellent fit for individuals or families who expect to incur medical expenses each year but are able to pay out of pocket for them. Though Roth IRAs can play a key role in retirement planning, HSAs’ triple bonus of having plan contributions be tax-deductible, letting the funds grow tax-free, and providing the ability to pull money out tax-free at any time is hard to beat!

Schedule a Complimentary Insight Meeting with one of our fee-only financial advisors.