As a real estate agent and, by extension, a small business owner, managing finances is a critical aspect of running a successful business. Unfortunately, financial mismanagement leads to common finretancial mistakes many agents make. These mistakes lead to dire consequences such as hefty fines, tax problems, and even bankruptcy. In this blog post, we will discuss the top 3 financial mistakes that real estate agents make. We’ll also provide actionable tips on how to avoid them.

Whether you are a seasoned agent or just starting in the business, this article will help you understand the importance of financial management. Keep reading for practical advice to keep your finances in order. So, let’s dive in and learn how to avoid these costly mistakes.

3 Mistakes Real Estate Agents Make

Real Estate Agent Mistakes #1 : Sitting on Too Much Cash

The Problem With Holding Too Much Cash

Real estate agents often make the financial mistake of sitting on too much cash in their business accounts. While it seems like a safe and conservative approach to managing variable income, holding excess cash hurts your business in the long run. Top-producing real estate agents are constantly battling the uneven income stream of seasonality.

The volume of transactions in the summer months can provide a significantly higher income potential than the lower volume months of winter. It’s not ideal to base your ongoing lifestyle around the ebb and flow of the market. Instead, a steady, consistent cash flow is preferable. Plus, when sales prices plummet (think the 2008-09 real estate and financial crisis), agents must brace for longer periods of potentially lower income levels. The problem with holding too much cash is that it’s not earning any interest. This means that you are missing out on potential returns that could help grow your business.

Solution: Creating a Personalized Cash Management Plan

To avoid this mistake, it’s crucial to implement a personalized cash management plan. Such a plan will adequately fund your lifestyle and provide a safety net to hedge against your variable income. A cash management plan won’t sacrifice the growth of your net worth in the process. The dollar value for each step of your plan will depend on your personal situation. We’ve provided some guidelines below to help you determine what makes sense for you.

Step 1 – Set Up a Spending Account

Typically, a checking account at your local bank or credit union serves as a spending account. A good benchmark is to have two months’ worth of living expenses in this account. This balance should be high enough that you’re not always worried about transactions clearing, but not so high that you’re losing money due to inflation.

Step 2 – Prioritize an Emergency Fund

For top producers, we recommend having an emergency fund with an additional four months’ worth of living expenses. However, the correct balance for your emergency fund is different for everyone, and your needs may change over time. Your emergency fund shouldn’t take any market risk, as you may need to use it at a moment’s notice. A high-yield savings account is an excellent option for your emergency fund, providing a sweet spot between risk and return. These accounts have FDIC insurance and do not fluctuate with the market, but typically earn more than five times the national average of traditional savings accounts.

Step 3 – Utilize your Brokerage Account as a Pour Over Account

Once Steps 1 and 2 have been fully funded, your brokerage account is the next step in your cash management plan. There is no specific guideline for this step, as it serves as the pour-over for any discretionary savings. This account is liquid and does not have any associated tax penalties for tapping the funds before retirement, allowing your net worth to grow according to the risk and return characteristics of the underlying positions you choose to invest in. While this account carries some risk, we do not consider it as part of your emergency fund. Instead, it is a backup to utilize in extreme emergencies or for funding your long-term financial goals.

Top Producer Tip: Our Cash Management Plan for Top Producing Real Estate Professionals has two more steps, but they fall outside the focus of this article. To learn about the last two steps and read more about our plan, download our free guide here.

Real Estate Agent Mistakes #2: Failure to Diversify

The Importance of Diversification in Your Net Worth Statement

As a Top Producer, you have likely built a successful career in real estate investment. However, it’s important to recognize the potential pitfalls of over-concentration in a single asset class. Let us be clear: There is nothing wrong with leveraging your expertise when the right deal presents itself!

That said, the problem arises when your net worth becomes overly concentrated in one single asset class. While real estate can be a lucrative investment, it can also be an illiquid and unpredictable one. In addition to the long-term risks associated with over-allocating to real estate, there is also the potential for short-term risks when both your net worth and personal income are subject to the same asset class.

How to Balance Your Net Worth

That’s why we advocate for a balanced net worth statement that includes a variety of asset classes. When diversifying your net worth, there are two main factors to consider: your financial goals and your financial values.

Financial Goals

Your financial goals are the first conversation to have when identifying what investments make sense on each line item of your net worth statement. Time horizon is the biggest driver in matching your financial goals to your investment selection. The sooner you need to utilize the asset in your financial plan, the less risk it makes sense to take with that investment. On the other hand, the longer the time horizon you need to liquidate the investment, the more risk you can take.

Based on your time horizon, the right investment for you could range from a high-yield savings account to a growth stock mutual fund in a brokerage account or a bond fund in your Solo 401(k). The key is to deliberately choose the investment that best aligns with your financial goals.

Financial Values

The next screen to run your investment selection through is “Does this investment fit within my financial values?” Your answer to the question “What is the purpose of money to me?” will reflect your financial values. Depending on your response, your choice in diversifying your net worth could be taken in a variety of directions.

Some people view money as a tool, while others see it as creating stability or providing flexibility. Whatever money means to you, it’s important to make sure that those values are reflected in your choice of investments.

Diversify Your Net Worth

While real estate can be a great investment, it’s important to diversify your net worth to reduce risk and increase stability. By intentionally selecting investments that align with your financial goals and values, you can create a well-rounded net worth statement that helps you achieve long-term financial success.

Real Estate Agent Mistakes #3: Forgetting Available Tax Breaks

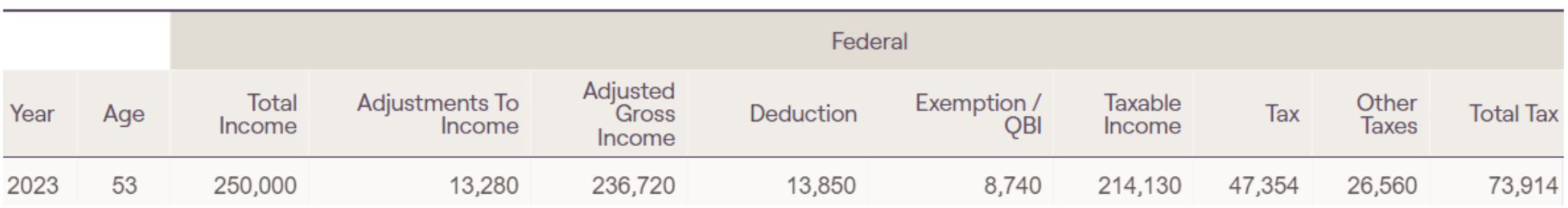

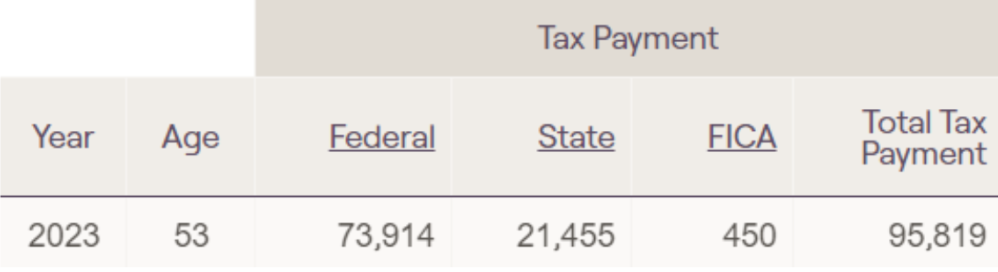

If you are a Top Producer, taxes are likely a reality you face every April 15th and every quarter leading up to it. Between federal, state, and self-employment taxes, the bill can add up quickly and eat into a meaningful portion of your take-home income. For instance, consider this case study of a Top Producer in Oregon: filing as single with no dependents and a Schedule C income of $250,000, their estimated total tax liability is $95,819, or just shy of 40%.*

*Estimated tax projection generated in RightCapital financial planning software.

The Benefits of Forward-Looking Tax Planning

A healthy lifestyle can positively impact your life expectancy. Similarly, forward-looking tax planning can greatly benefit your tax liability. Tax planning is a piece of your financial plan that should be addressed more often than just every spring. While most Top Producers are seasoned to the rhythm of paying taxes and are rarely caught off guard by a tax bill, there routinely lies room for optimizing their tax bill with some forward-looking planning versus the backward approach commonly taken come Tax Day.

Remember, just as a car’s windshield is bigger than the rear-view mirror for a reason, tax planning can be even more important than tax reporting. Here are a few simple tax planning tips Top Producers can implement throughout the year:

1. Contribute to a Health Savings Account

Health savings accounts (HSAs) are designed to facilitate savings for medical expenses. The best part about an HSA is that it allows for both a tax deduction in the year that you make the contribution and a tax-free distribution when you use the funds to pay for a qualified medical expense. The deadline for making an HSA contribution for a given tax year is the following April 15, which means you have some flexibility in the timing of the contribution.

2. Contribute to a Solo 401(k) or Other Retirement Account

While the correct retirement account to select can be different for each Top Producer’s personal situation, the Solo 401(k) is often a great option to consider. One of the most significant advantages to a Solo 401(k) is that the contribution limit goes all the way up to $66,000 for the tax year 2023. Additionally, if you are age 50 or over, the annual limit is increased to $73,500 for 2023. The high contribution limits of the Solo 401(k) allow you the ability to build up a huge deduction against your earned income.

3. Plan Your Expenses Around Your High-Income Years

Every December, it is a good idea to take a look at your expected profit for the year and determine where you stand in comparison to your previous years’ earnings. Are you crushing it this year? Consider purchasing big-ticket business expense items in your highest income years when you will be in the higher tax brackets. Expenses such as computers, cellphones, cameras, and other big-ticket purchases have the most value as a deduction in the years that you make the most money.

4. Verify Your Choice of Business Entity Makes Sense

One of the bigger decisions for running your real estate business is selecting the entity type you wish to operate as. While most agents choose to operate as sole proprietors or LLCs while starting out, some circumstances may favor switching your business to function as an S corp. Make sure to talk these options through with your financial planner and CPA to verify that the increased costs and complexity associated with operating an S corp are outweighed by the tax advantages.

5. Maximize Your Charitable Giving’s Tax Efficiency

Although the primary motivation behind donating to a charitable cause is to support it, it’s wise to explore all your options when it comes to giving, particularly for tax benefits. As tax laws are continually evolving and standard tax deductions are increasing, planning your charitable donations is critical to reaping any tax advantage for your contribution.

Several strategies could make sense for your specific situation when it comes to giving. You could give appreciated stock. Appreciated stock “stacks” your charitable gifts every other tax year by donating in January and December for annual gifts. Or you could donate directly from your IRA accounts if you’re over 70 1/2 years old. We advise you to consult your financial planner and tax advisor before selecting the best option for your circumstances.

Real Estate Agent Mistakes: We Can Help

In conclusion, Top Producers have unparalleled potential for wealth creation, but they also face specific financial challenges. Successfully navigating issues like variable income, over-reliance on real estate, and taxes can indicate their financial success in the future.

If you’re seeking the help of a financial planner specializing in Top Producers’ needs, check out our process. To initiate the conversation, we recommend scheduling an insight meeting with our team. An initial meeting will determine if we’re the right fit to help you optimize your financial future.